The Opportunity Signal: How to Pick the Right Customer Segment

Like most startups, we made a lot of pivots in the early days of building OpinionX.

Back in early April 2021, we were targeting Product Managers as our key customer segment when a viral Reddit post unexpectedly caused a wave of early-stage founders to sign up. Our response? We instantly pivoted our positioning to merge PMs and founders together into one vague customer segment that we called “Product Builders”.

In hindsight, that “Product Builders” mega-segment was obviously a silly mistake. But it had been 6 months since we launched and this was our first big sign of traction — we were desperate and couldn’t afford to ignore it. A few weeks later, when we were trying to fix that mistake, we discovered a concept that completely changed the way we think about picking the right customer segments and how to match that segment to the right acquisition channels.

It all revolves around this simple idea of an Opportunity Signal…

When different customer segments share the same use case

^ Our viral Reddit post drove a wave of sign-ups that lasted for about 3 months.

So it’s April 2021 and we’ve just gone viral on Reddit. A bunch of PMs and founders are signing-up to OpinionX all for the same use case — to get their users to stack rank lists of problem statements.

But how each of those two groups used their stack-ranked data was slightly different. Founders wanted to figure out which new product idea to build, while PMs used it to decide which features to build for customers next. That difference sounded pretty trivial to us initially, so we just ignored it and focused on keeping our newfound traction alive instead.

Because all these sign-ups were coming to OpinionX from the viral Reddit post, they all shared the same context. But once that viral post dried up and we had to go find new acquisition channels, founders and PMs suddenly started looking like two very distinct customer segments…

The first signs of our impending mega-segment schism

The features that new users were requesting showed the first sign that our “Product Builders” mega-segment was falling apart.

Founders were very loudly asking for ways to recruit survey participants from inside OpinionX. Product Managers already had a bunch of users to engage, so they didn’t care about recruitment and wanted us to keep adding new analysis functionality or question types.

Integrating a participant recruitment provider was going to be a huge project that would require our full development resources for 3-6 months, so we couldn’t just keep appeasing both segments. It was time to make a decision — were we building OpinionX for founders or PMs?

To figure out which segment was a better customer, we made a list of every successful project on OpinionX and asked all those users if they could spare 10 minutes for a video call.

During those calls, founders talked about how our viral Reddit post had opened their eyes to a big gap in their thinking about idea validation and product building. PMs, on the other hand, didn’t seem enlightened in the same way — they were already trying to find ways to prioritize customer problems, OpinionX just offered an easy tool for doing that robustly at scale.

We didn’t realize it right away, but this was our first big discovery…

The right customer segment is already out there looking for you

Because PMs and founders were using OpinionX to conduct the same type of research, we hadn’t considered that there would be a big difference in why they had decided to give OpinionX a try.

Each product cycle, PMs would have to justify their roadmap decisions to their leadership team. The stress of nailing that presentation was keeping them up at night, so they were proactively searching for a solution to improve how they prioritized.

Founders, on the other hand, were problem reactive. They were often months (or even years) deep into building a product before realizing they were addressing a need their customers didn’t care about. Most hadn’t even diagnosed this as the cause of their problems, so OpinionX didn’t seem like an obvious solution to them unless we educated them about idea validation and user research best practice.

The tricky part, however, was that when we asked all these successful users whether our product solved their problem, both segments would say yes. It was only when we looked at founders and PMs outside our user base that became clear only the PMs were trying to do anything to address their own need.

If a customer segment sees a problem as only a mild inconvenience (like the founders segment in our case), then you’ve got an uphill battle to force those customers to care about the problem your product solves. Otherwise they’ll do nothing — nobody has the time to care about solving their mild inconveniences.

Alternatively, a customer segment that sees a problem as a high priority will go searching for a solution. They’re basically emitting a big bright Opportunity Signal saying “I’m desperate to solve this problem, can someone PLEASE give me a good solution?!”.

That’s how we figured out that PMs made more sense for us to focus on.

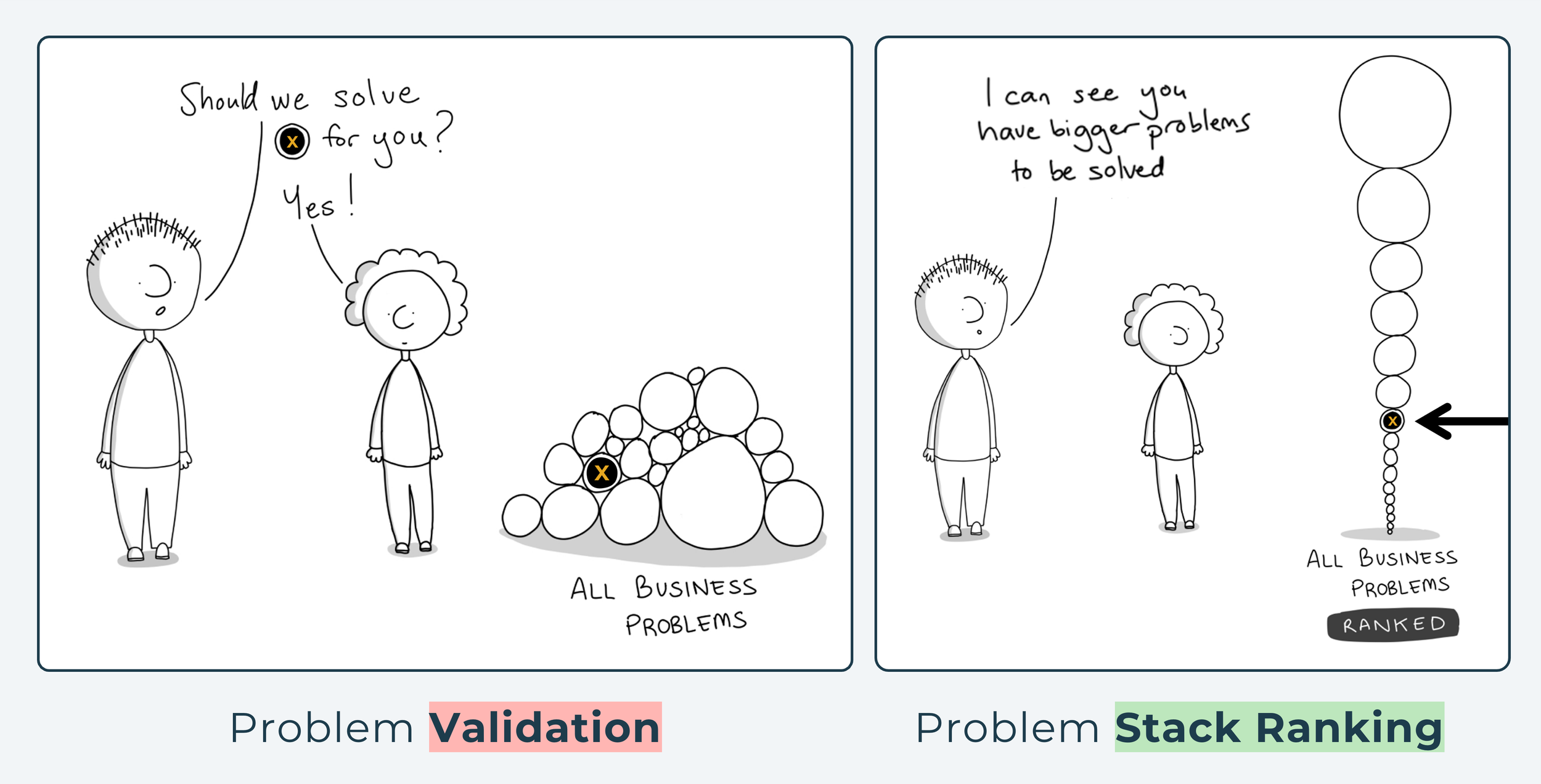

^ Validating that a customer experiences a problem doesn’t mean they care about finding a solution.

We didn’t realize it at the time but this Opportunity Signal concept had far-reaching implications beyond just the problem and customer segment we would build OpinionX for…

The best Opportunity Signals are big and easy to intercept

When that wave of founder sign-ups started in April 2021, we went looking for more acquisition channels to keep the top-of-funnel tap flowing.

Because founders didn’t understand that this should be a priority of theirs, our strategy was to ‘educate and intervene’ by giving workshops at accelerator programs, partnering with startup communities, speaking on relevant podcasts, and finding a way to get on stage at founder conferences.

Founders were always pretty happy to chat with us, but they rarely ever turned into good customers. On the other hand, PMs wouldn’t give us even 5 minutes for a Zoom call, but they were organically finding OpinionX on Google or through word-of-mouth. Even more importantly, they were launching successful stack ranking projects without needing any help from us.

This seems pretty obvious now, but it took a while until it clicked for us — the best way to acquire customers depends on what stage of Opportunity Signal they’re at.

The higher the pain of the problem you solve, the less you need to convince them to try your product and the more they’re likely already searching for a solution like yours.

The idea here isn’t just “build it and they will come,” it’s “build it and put it where they’re already searching for a solution.” So let’s break down the five stages of problem consideration and see how each predefines the customer acquisition channels that are available:

1. OVERLOOK

Status: Unaware of Problem/Goal

It’s common to hear people say that educating customers is expensive but they don’t tend to explain why. To ‘Educate & Intervene’ means to change your target customers’ priorities, which requires you holding their attention for a considerable amount of time (and therefore money).

Matt Lerner, CEO of Startup Core Strengths, hits the nail on the head when it comes to targeting problem unaware customers: “As an unknown startup, it’s hard enough to even get people to read or click on your ads, let alone rewrite their beliefs or change habits.”

If you value your sanity, don’t target customers who have an undetectable opportunity signal. There’s possibly a different customer segment with the same problem that cares a lot more about solving it — spend your time finding and serving them instead.

—

2. SEE

Status: Aware of Problem/Goal

Once your customer is aware of the problem/goal, then traditional channels like outbound sales and display advertising start to become relevant. However, the big trap here is assuming that they care about solving the problem just because they’re aware of it.

In my opinion, you shouldn’t target these customers for any new product or feature. Focus on THINK and ACT groups who already care about solving your problem and then expand to SEE stage customers when you’ve exhausted the low hanging fruit.

—

3. THINK

Status: Researching Solutions

Only once the problem becomes a high priority will your target customers start emitting a Opportunity Signal you can easily intercept. This is when scalable sales and marketing channels like SEO and search ads become truly effective strategies.

However, potential customers at the THINK stage aren’t always ready to solve the problem right away. The majority are looking for informative content to better understand their problem or knowledge gap, not buy/try a solution right away.

We target PMs in the THINK stage by writing informative blog posts about problems that our product could be a great solution for. Instead of immediately positioning OpinionX as the solution, we first make sure and give them the info they were looking to learn about when they found our content. Here are some examples of high-converting THINK-oriented blog posts:

—

4. ACT

Status: Comparing Solutions

The difference between THINK and ACT customers lies in their search intent. People at the THINK stage are looking for informative content, while ACT customers are searching with much higher commercial intent. They’re not just looking to learn about a topic; they want to understand and compare the features, benefits and pricing structure of the best products for solving their problem.

An example of a well-performing piece of content I’ve made for customers at the ACT stage: Comparing the 7 Best Free Online Ranking Survey Tools in 2023

—

5. REFLECT

Status: Recurring Impact

Once your customer successfully implements a solution, they move into the REFLECT stage. As long as you can keep the problem at bay (and not create any new pains), their perceived pain remains low and they’ll retain you as their solution of choice.

But retention isn’t the only ingredient in this final stage. There are three objectives to aim for once you start delivering customer value:

Retain: How can you continue delivering value to keep this pain at bay? How can you communicate the value you’re delivering for them now that the pain is no longer top of mind?

Refer: Who else do they know that feels this pain? How can we encourage them to share this solution with others like them?

Upsell: How can we expand on the value we’re delivering so that we can grow the size of their account over time?

Target customers in the THINK/ACT stages wherever they’re already searching for your solution

For most unmet needs, there exists a perfectly reachable segment of potential customers that are not just problem aware but are actively searching for a great solution like yours. Sometimes these customers are simply using different terminology to describe the problem, so they end up flying under your radar.

To successfully target customers in the THINK and ACT stages, you’ll need to understand:

The high-priority problem your target customer is trying to solve.

The language they use to describe that problem.

The product categories where they expect to find a solution.

Where they’re looking for THINK and ACT information.

The best founders spend the time to research and articulate these four ingredients because, at the end of the day, solving the right problem for the wrong customer segment is the same thing as being wrong overall.

About the author:

Daniel Kyne is the Co-Founder and CEO of OpinionX, a research tool for stack ranking people’s priorities. Thousands of companies use OpinionX to understand what’s most important to their customer, colleague or community — helping inform key strategy and prioritization decisions with real data instead of internal assumptions and politics. Create unlimited stack ranking surveys for free at app.opinionx.co.