The Value-Adoption Matrix: How To Find Untapped Opportunities In Your Existing Features

Building new features is a very risky use of your time — 80% of features are rarely or never used by customers.

But what’s the alternative? Teams build new features to improve user activation, conversion and retention — how can they impact these metrics without building new stuff? In reality, most teams are sitting on an untapped goldmine of existing features, they just don’t realize it. To check whether you’re one of those teams, try to answer these three questions:

1. What’s the adoption rate of my existing features?

2. Which features are most important to my customers?

3. Which important features are used least by customers?

A feature that customers perceive to be valuable that isn’t widely used is an untapped opportunity because it’s likely:

(i) An undiscovered feature that most customers don’t know about.

(ii) A poorly designed feature that most customers find unusable.

(iii) An add-on that a specific customer segment cares a lot about.

90% of the work on these features is already done. Identifying these kinds of untapped opportunities can boost your key metrics with 10x less developer time than chasing new features — that’s how you win in a conservative market focused on bottom-line efficiency.

This post explains how to find these untapped opportunities in your existing features and diagnose which of the three opportunity types they belong to. Let’s jump in…

1. What’s the adoption rate of my existing features?

You’d be surprised how many customers don’t know about the features you already offer — on average, 95% of total product usage goes to only 20% of features.

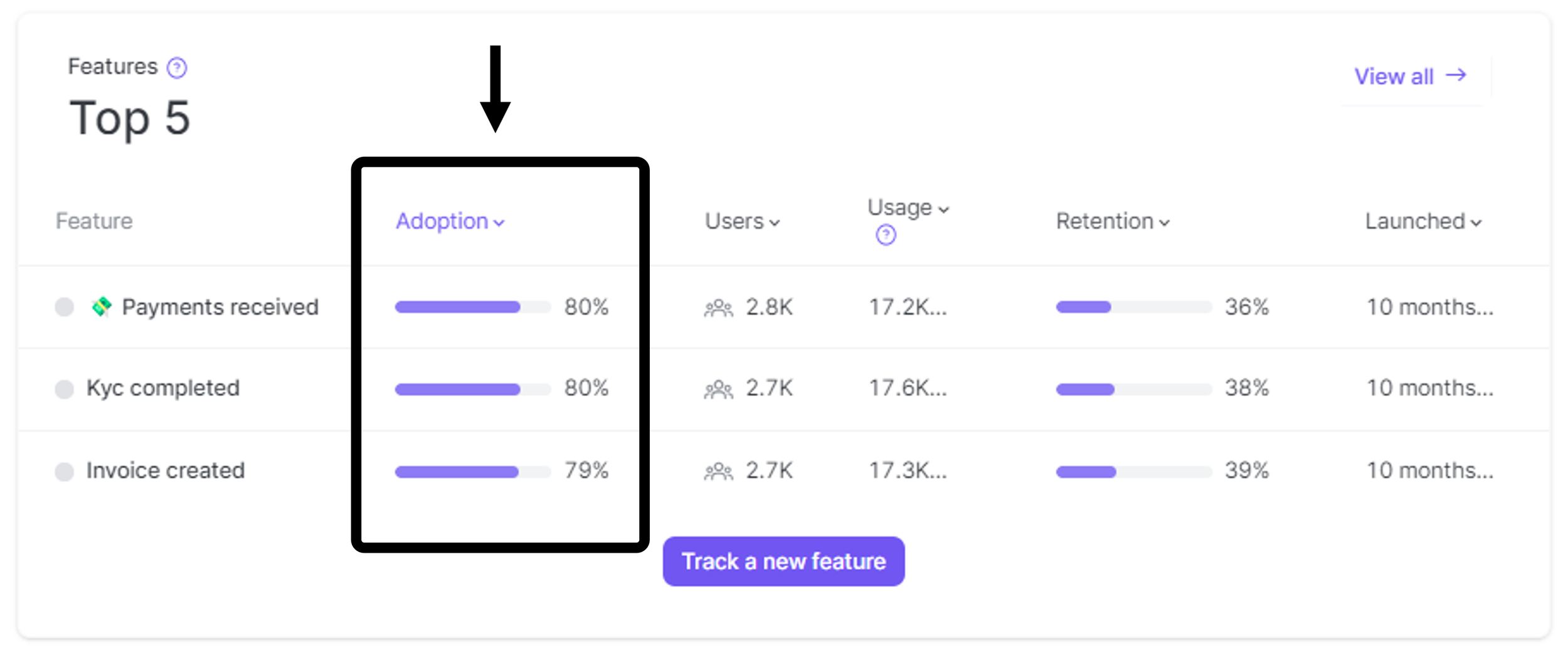

Thankfully, feature adoption is a relatively easy stat to collect. We use June for product analytics and it comes with a feature specifically for tracking feature adoption. Alternatives to June with feature adoption tracking include Pendo, Amplitude and Heap. Here’s an example of the Feature Adoption report on June:

Example “Feature Adoption Rate” report on June.so

Export this list of features and their adoption rate to an external spreadsheet. (If you don’t have feature adoption data, check out my alternative approach at the end of the post.)

2. Which features are most important to my customers?

We need a way to measure customers’ perceived value of our existing features. To start, we need to translate our list of features into the capabilities they enable for customers.

Let’s take the “feature adoption report” from the screenshot above as our example. The capability this feature enables would be “Measure the percentage of customers that used a feature in a given period.” The less jargon and inaccessible terminology, the better (use these principles if you need help writing your ‘capability statements’). Some features might translate into multiple different capability statements, which is perfectly fine.

To measure perceived value, we’ll use a simple pairwise ranking survey. Pairwise ranking shows customers our list of ‘capability statements’ in head-to-head pairs with a question like “If our product could only do one of the following things for you, which would you pick?”. At the end of our survey, we’ll see which statements win the highest percentage of these pairs — aka the highest value capabilities according to customers.

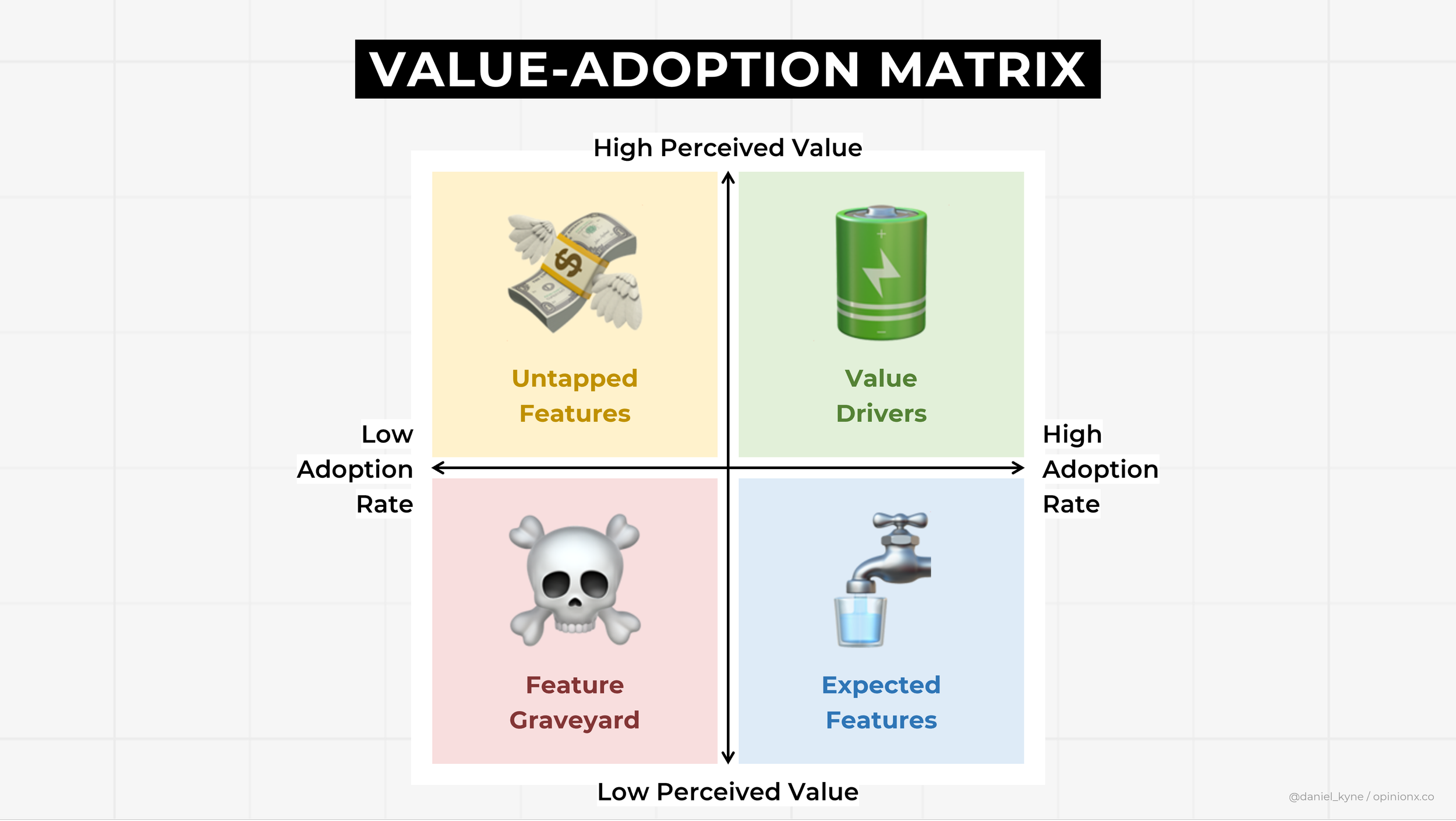

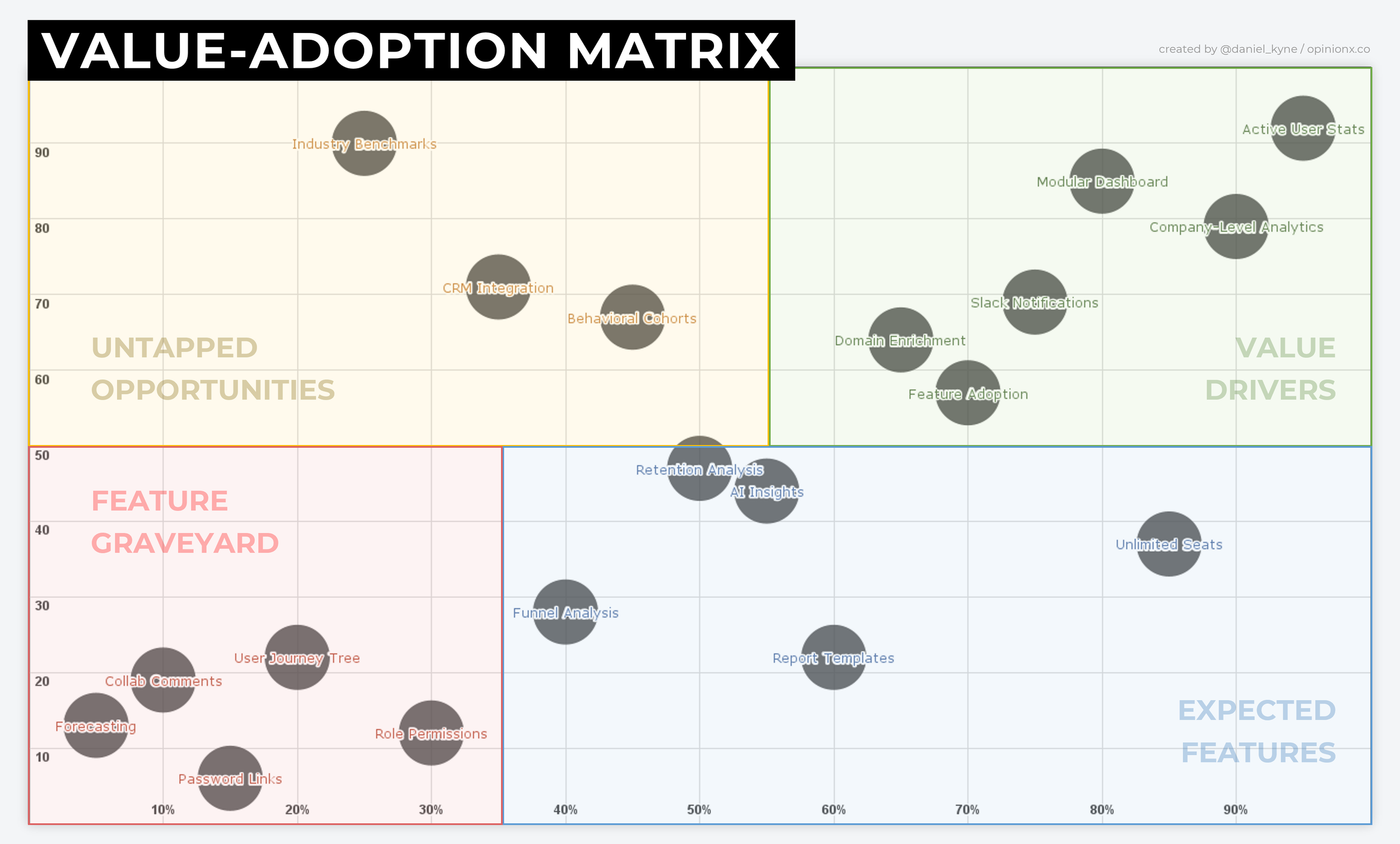

3. Which important features are used least by customers?

Once your pairwise survey is finished, export the results and add them to your spreadsheet. Now you should have a table with (A) Feature, (B) Capability Statement, (C) Adoption Rate, and (D) Perceived Value Score, which we can turn into a simple scatter plot or bubble graph.

Untapped opportunities are pretty easy to spot in the top left quadrant of the graph — what’s more difficult is understanding why they are untapped. That leads us to the three opportunity types….

(i) An undiscovered feature that most customers don’t know about

Some features have low adoption because most users just don’t know it exists yet. There are many ways to tackle this, ranging from updating your information architecture so that the feature is located where users would expect to find that functionality, to more surface-level changes like adding hotspots and tooltips to newly-launched features. More on this in the case study section.

(ii) A poorly designed feature that most customers find unusable

Sometimes a feature has poor adoption because you’ve made it too difficult to use the feature or it’s limited in ways that prevent users from getting the full extent of the expected benefit. You can use unmoderated user tests, session recording tools like Hotjar, or just ask some users to jump on a video call and watch them try to find and use the feature. If poor design is the root cause, any of these methods will surface this pretty quickly.

(iii) An add-on that a specific customer segment cares a lot about

The value-adoption graph won’t show you that some features with a low adoption rate overall actually have a high adoption rate within specific customer segments. This is a really important insight to clarify because a feature with segment-specific adoption is a perfect candidate to repackage as a paid add-on for incremental revenue growth.

It may be tricky to look at segment-specific feature adoption rates on product analytics tools, but it’s very easy to segment the “perceived value” data. Take your pairwise comparison results and apply a segmentation filter to isolate users from specific job titles, geographies, company sizes, use cases, etc. These filters can easily be set up by asking a multiple-choice question alongside the pair voting in your pairwise survey tool of choice.

Case Study

We recently studied users’ perceived value towards the main features in OpinionX. We found that our highest-retention customers saw segmentation as a very valuable capability, but the majority of our paying customers didn’t know we had a segmentation feature at all.

Before this research, segmentation had only been accessible in one place — behind a tiny little icon at the top of each results table — and if you activated it, it only applied to that one results table.

Based on these insights, we…

1. Turned that tiny icon into a larger button with a text label so that it was easier to notice.

2. Extended the functionality of segmentation to apply to all your results, not just one table.

3. Created a floating button to make it clear that segmentation is the primary analysis method.

4. Allowed users to click any multiple-choice graph to ‘magically’ activate a segmentation filter.

5. Added a paywall with embedded video that shows why segmentation is so valuable for analysis.

We made this key feature easier to discover, more powerful to adopt, and clearer for freemium users to understand why it’s valuable to consider upgrading to unlock it. And that only covers what we’ve improved so far — months later, we’re still working on expanding the functionality and usability of segmentation based on this one research project.

Alternative Approach → Building a Value-Adoption Matrix Without Feature Adoption Analytics

If you don’t have feature adoption analytics, you can rely on stated-usage data. Using a multiple-choice question, show each feature with a list of usage options for the past month/quarter: (1) Never Used, (2) Rarely Used, (3) Moderately Used, (4) Continuously Used. This multiple-choice data can be exported and graphed against the “perceived value” pairwise comparison results to form the graph. While stated usage is obviously not as reliable as analytics data and also requires more manual respondent input, it is a viable alternative for early-stage teams without an analytics setup.

Top Takeaway → Separate Untapped Opportunities from Graveyard Features

The easiest mistake you could make while following this approach would be to waste your time optimizing low-value features. If your customers perceive a feature to offer low-value capabilities and it has a tiny adoption rate, kill the feature. Adoption rate data alone isn’t enough to inform your prioritization decisions. If in doubt, talk to users to understand why they have these opinions.

~~~

If you’re interested in ranking your customers’ priorities, problems or opinions, there’s no better research tool than OpinionX. You can get your first stack ranking survey created in minutes (for free!) and it comes packed with analysis features purpose-built for ranked data (like segmenting your results to compare how priorities differ between your customer segments).

Thanks for taking the time to read this post! If you enjoyed it, consider subscribing to our newsletter The Full-Stack Researcher, where we share actionable research advice with thousands of product teams and startup founders: