Van Westendorp for Pricing Research (Survey Guide)

What is a Van Westendorp?

A Van Westendorp is a survey method used to measure a product’s optimal price. Known specifically as the Van Westendorp Price Sensitivity Meter, or sometimes just VM PSM for short, this survey method shows you how price changes impact your customers’ willingness to pay for your product.

Why people use Van Westendorp surveys for pricing research

There are two main challenges when making pricing changes — how to avoid leaving money on the table by charging too low a price and how to avoid turning too many customers away by setting your price too high. Ideally you should find an optimal price point that generates the most revenue possible by balancing your price with their willingness to pay.

How do you find this optimal price? Unfortunately, hypothetical questions like “how much would you pay for this product?” tend to produce unreliable answers — a 2010 study found that people’s estimate of their willingness to pay for a public good was 3x higher when asked as a hypothetical question compared to their actual willingness to pay for the same product in a choice-based experiment that included simulated payment.

The Van Westendorp survey gets around this “hypothetical bias” limitation by asking contextual questions about cheap and expensive pricing limitations rather than directly asking someone to imagine what they might pay. This gives people better context to realistically consider their price expectations. Using their answers to these questions, the Van Westendorp survey shows you the price point that the fewest people said was either too cheap or too expensive → ie. the optimal price!

How does the Van Westendorp survey work?

The Van Westendorp survey asks four simple questions:

At what price would it be so cheap that you would question the product’s quality? → Too Cheap

At what price would you consider the product to be a great value bargain? → Acceptably Cheap

At what price does the product feel expensive but still within consideration? → Acceptably Expensive

At what price would this product become too expensive to even consider? → Too Expensive

By analyzing the answers submitted by a large group of participants to these four questions, the Van Westendorp method can figure out the optimal price point where these “cheap” and “expensive” expectations overlap.

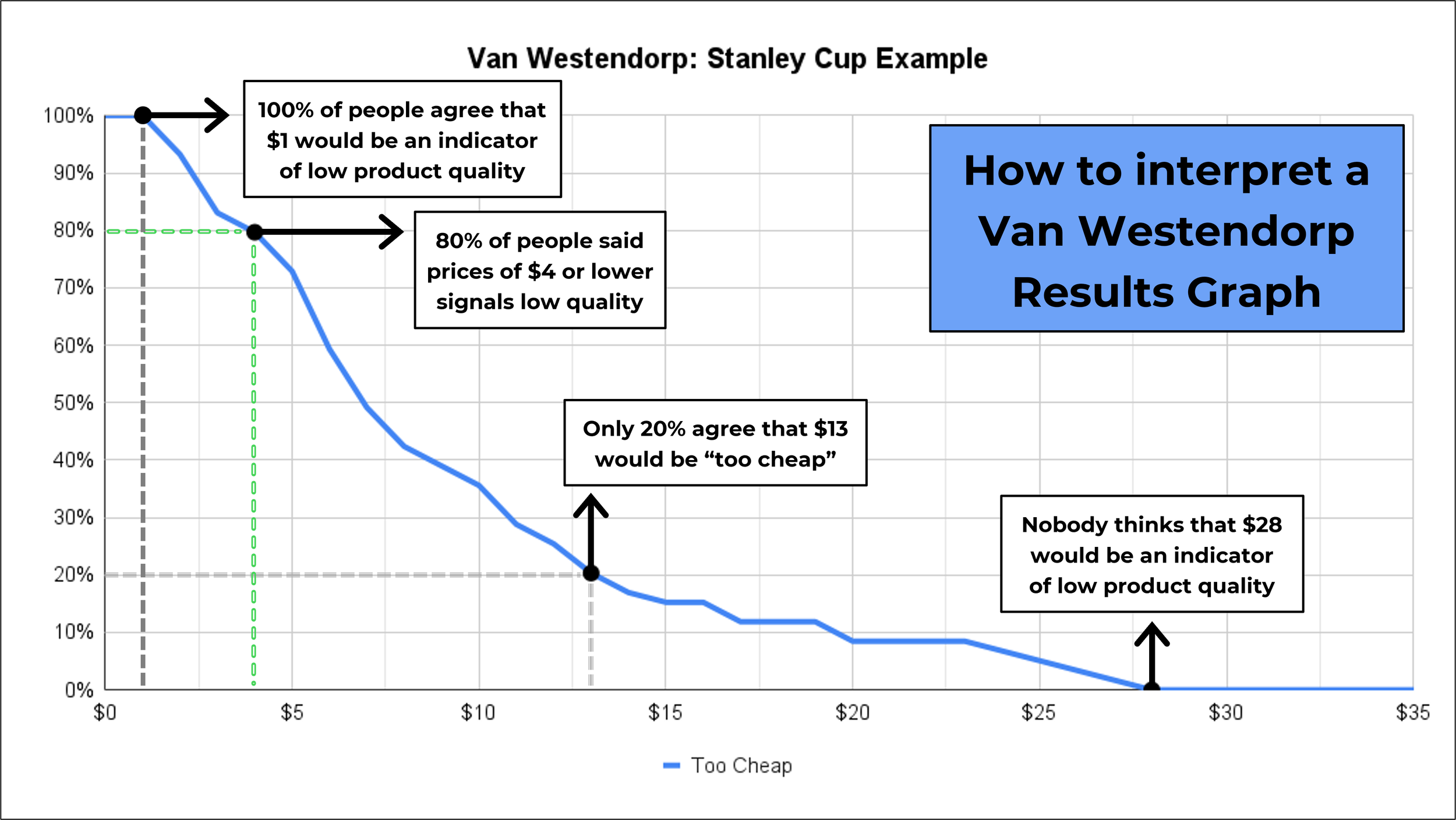

The best way to understand how the Van Westendorp graph works is to look at just one line at a time. For example, I ran a mock Van Westendorp survey using a 30oz Stanley Cup as the product example. Let’s start by including only the answers from the “Too Cheap” question…

The horizontal axis shows the range of prices mentioned in respondents’ answers. The vertical axis shows the percentage of participants who said a price point was, in this case, “too cheap.” Therefore this line graph tells us that:

100% of people agreed that they’d question the quality of a Stanley Cup if it cost $1.

80% of people said that a price of $4 would be a signal of low product quality.

Only 20% of people said that $13 was too cheap to consider buying.

0% said that a $28 price tag would indicate low product quality.

Here’s how to see these insights in just this blue line:

The lines for “Too Cheap” and “Acceptably Cheap” always run from top-left to bottom-right. The “Acceptably Expensive” and “Too Expensive” lines run from bottom-left to top-right direction because they’re based on the opposite logic — ie. 0% of people said $1 was too expensive to consider.

Ok, so now you should be able to interpret what these lines mean, but what does the overall graph mean? The key insights from a Van Westendorp survey are found at the points where these four lines intersect…

1. Optimal Price

In a Van Westendorp survey, the price where the lowest percentage of people said the product is “Too Cheap” or “Too Expensive” is called the Optimal Price. In the example below, only 3% of people said $26 is too cheap (blue) while another 3% of people said $26 is too expensive (red), which means that ~94% of people think $26 is a suitable price.

2. Acceptable Price Range

The “Acceptable Price Range” is the gap between two points on this graph…

i. Point of Marginal Cheapness → where the “Too Cheap” and “Acceptably Expensive” lines intersect. Any price lower than this point would result in a higher percentage of customers thinking your product is too cheap to be of good quality than the percentage of customers who think that your product is a little expensive but still within consideration.

ii. Point of Marginal Expensiveness → where the “Acceptably Cheap” and “Too Expensive” lines meet. If you set your price higher than this point, you’ll have more target customers who think your product is priced beyond consideration than the number of customers who think it is a bargain of great value.

Now that we know how to interpret Van Westendorp results from the line graph, I’ll explain how to gather this data in the first place…

How To Create A Van Westendorp Survey (Simple Step-By-Step Guide)

Step 1: Survey

A Van Westendorp is a survey template that you can run on whatever tool you’d like. The examples in this guide are from OpinionX because its free tier gives you unlimited surveys with unlimited participants (unlike almost every other survey tool which is capped at 10-50 responses on the free version). OpinionX also has a Number Response question type that only accepts numerical answers, which is ideal for VanW surveys because it means you won’t have to manually clean up your data afterward.

To start, I’ll add four Number Response questions to my survey using the Van Westendorp template:

At what price would [this product] be so cheap that you would question its quality?

At what price would you consider [this product] to be a great value bargain?

At what price does [this product] begin to feel expensive but still within consideration?

At what price would [this product] become too expensive to even consider?

Below is an example of how I put these survey questions into my Van Westendorp survey on OpinionX:

⬆️ This example is interactive, try it yourself! ⬆️

(survey via OpinionX)

Step 2. Spreadsheet

Turning your survey results into a Van Westendorp graph is much easier than you might expect! In fact, I have made a free spreadsheet template for you that automatically turn your survey results into the VanW line graph. The best part is that you can even connect this sheet directly to OpinionX so that the results update in real-time whenever someone new completes your survey!

Here’s what the Van Westendorp results template looks like on Google Sheets:

This free Van Westendorp analysis template has three main sections:

1. Survey Data → Link this to your OpinionX survey for real-time updates or manually copy/paste your data here once your survey is complete.

2. Auto Analysis → This section automatically turns your survey responses into the format required for creating a Van Westendorp line chart.

3. VanW Results → The line chart populates automatically and the three key numbers are identified for your Optimal Price and Acceptable Range.

There are two ways to get results into this spreadsheet:

Connect your survey to Google Sheets so that the results update automatically anytime someone new completes the survey.

Export your results, clean the data manually, structure it in the correct format, and then copy/paste it into the template.

The copy/paste approach does not require any explanation. Once you copy/paste your results in using the right format, the template will update automatically, like this:

To create a real-time Van Westendorp dashboard, open the Export menu on your OpinionX survey and link your survey to Google Sheets by clicking the “Connect” button:

Once you complete the Google Sheets connection process, your browser will open up a second tab with your survey results like this:

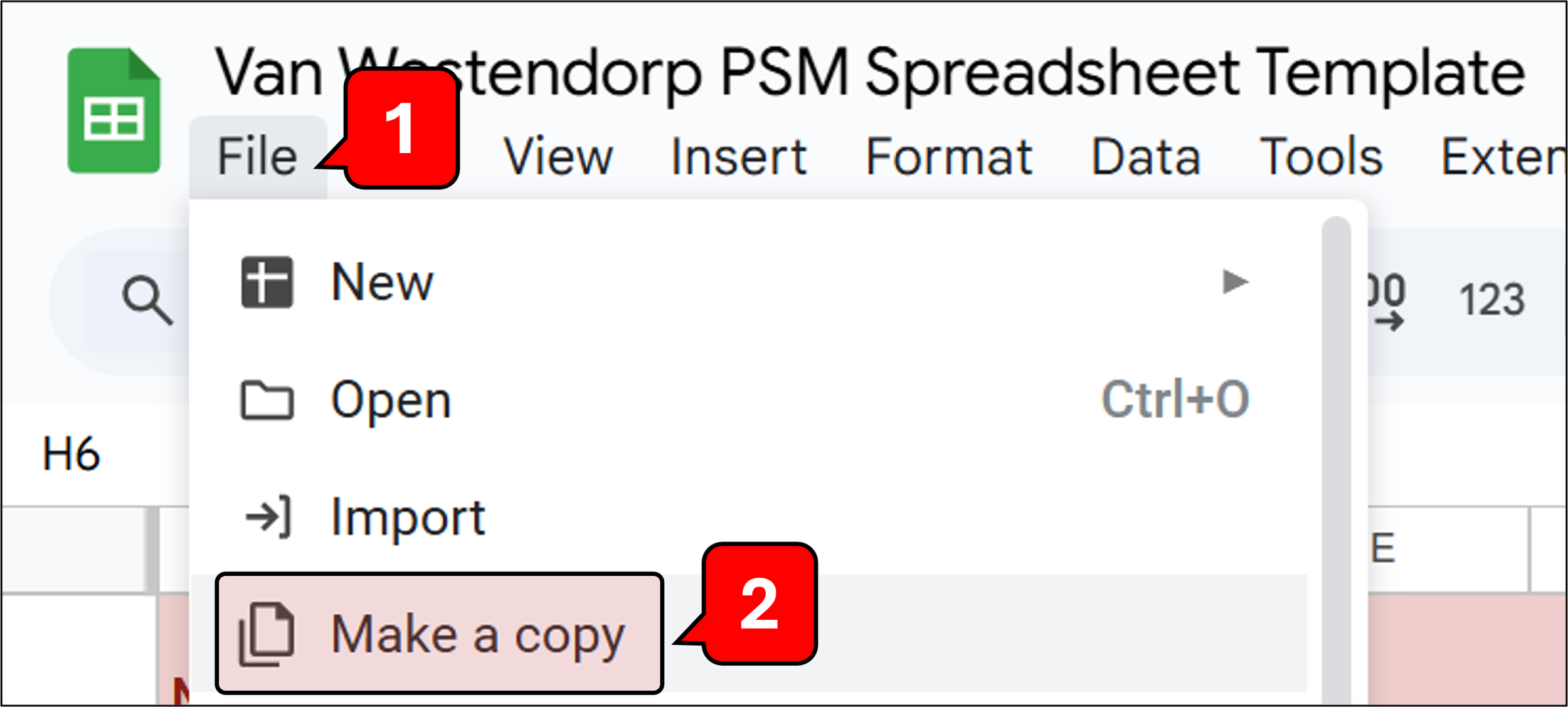

You don’t need to change anything here (I even recommend leaving the tab name as “Sheet1”, as the formulas are designed specifically to pick this up and require minimal customization). Instead, open the template in a new window, click “Make A Copy” → “Existing Spreadsheet”, and search for the name of your OpinionX survey.

Some things to note about this template:

The spreadsheet opens in view-only mode. To make your own editable copy, click FILE → MAKE A COPY.

The spreadsheet includes two tabs, one with the dashboard and the other with example survey data.

If you reuse this spreadsheet template elsewhere, please attribute credit to this guide as the original source.

Access the template on Google Sheets here:

→ Free Spreadsheet Template for Van Westendorp Surveys ←

Pros and Cons of Van Westendorp Surveys for Pricing Research

Some factors to consider before jumping into your first Van Westendorp project…

🟢 Advantages

• Easy Setup → You don’t need to learn any advanced survey methodology. The Van Westendorp method requires just four simple number response questions and can be included in any normal survey along with other questions.

• Easy to Complete → Van Westendorp surveys are so simple that even kids can complete them. According to Brian Balfour (founder of Reforge, the top professional development program in tech), the Van Westendorp method reduces the usual bias found in stated preference surveys “because it’s not a single question about a single point, but a number of questions that help you triangulate somebody’s true willingness to pay.”

• Easy To Analyze → Anyone can turn their survey data into a VanW line graph using a simple spreadsheet template and then identify their optimal price from that graph without requiring any background in math or data science.

• Easy To Understand → The “optimal price” is where the highest percentage of target customers say the product is neither too cheap nor too expensive — this is easy for anyone to understand and it intuitively makes sense why this would be valuable as the primary output from a pricing study.

🔴 Disadvantages

• Assumed Intersection → Van Westendorp graphs on Google Images always show an intersection occurring between the “too cheap” and “too expensive” lines. This is not guaranteed! An intersection between these lines often occurs based on the answers of a small minority of respondents (which in itself could be considered a disadvantage of the VW method too). Surveys with a low number of participants have a higher chance of no intersection occurring. However, if your VanW survey ends up with no Too Cheap/Expensive intersection, you can still assume an optimal price within the range between the Too Cheap hitting 0% and Too Expensive leaving 0%.

• Unsuitable for testing bundling → Respondents are better able to accurately consider their price expectations for a single product offering shown in isolation, whether this is your overall product or one specific feature. If you want to conduct a pricing study for a bundled product offer (ie. many products put together into one offer) or a complex offering made of many features (like a pricing tier on a SaaS product), you should consider running a conjoint analysis survey instead. Conjoint analysis is also popular in pricing studies because it is a multi-variable ranking method, which means it lets you rank categories like price, brand, and size to see which has the most influence over customers’ purchase decisions, while also ranking the options within each category, like small, medium, and large for the ‘size’ category. Conjoint also comes with some reporting formats that are purpose-built for pricing studies, like marginal willingness to pay and market simulators.

— — —

Parting Advice

Two things to consider including in your survey alongside the four Van Westendorp questions:

(i) Segmentation

In what ways will you want to filter your results afterward? A good Van Westendorp study does not just look at the overall results, it identifies which customer segment is willing to pay the most for your product.

Consider before launching your survey what ways you will want to filter or compare your results — a good starting point is to think about demographics (age, gender), firmographics (company size, department), or geographics (continent, city). Then plan ahead to have this data available during analysis, either by importing this data or by including some simple multiple-choice questions in your survey to collect it. For example, I always like to compare free users versus paying customers for any survey I run with my own userbase.

Once you’ve got this data, you can filter or compare these groups in one click using OpinionX’s segmentation features. You can also define more complex segments using logical expressions, like filtering your results to include only Enterprise tier customers in Canada working in Product Management. Once a filter is applied, any exported data will match your segmentation configuration, making it an easy way to tailor the data you will paste into the spreadsheet template.

(ii) Identifiers

Once you have identified segments with the highest optimal price, you’ll want to be able to understand why those customers are willing to spend so much more. Having identifier data associated with participants — either by asking for a name/email in your survey or by importing data from your CRM — will allow you to arrange follow-up interviews with survey respondents that meet your segmentation criteria and also personally displayed a high willingness to pay.

Create your own Van Westendorp survey on OpinionX today for free with unlimited participants. OpinionX is used by tens of thousands of companies for customer research, ranking user preferences, and conducting pricing studies like VanW and Willingness To Pay surveys.

— — —

Enjoyed this blog post? Thousands of founders and product teams subscribe to our newsletter, The Full-Stack Researcher, for actionable user research advice like this guide delivered straight to their inbox:

About The Author:

Daniel Kyne is the Co-Founder of OpinionX, a free research tool for stack ranking people’s priorities — used by tens of thousands of teams to better understand what matters most to their customers. OpinionX comes with a bunch of research methods for pricing studies, including conjoint analysis and marginal willingness to pay reports. Create your own Van Westendorp survey for free on OpinionX!